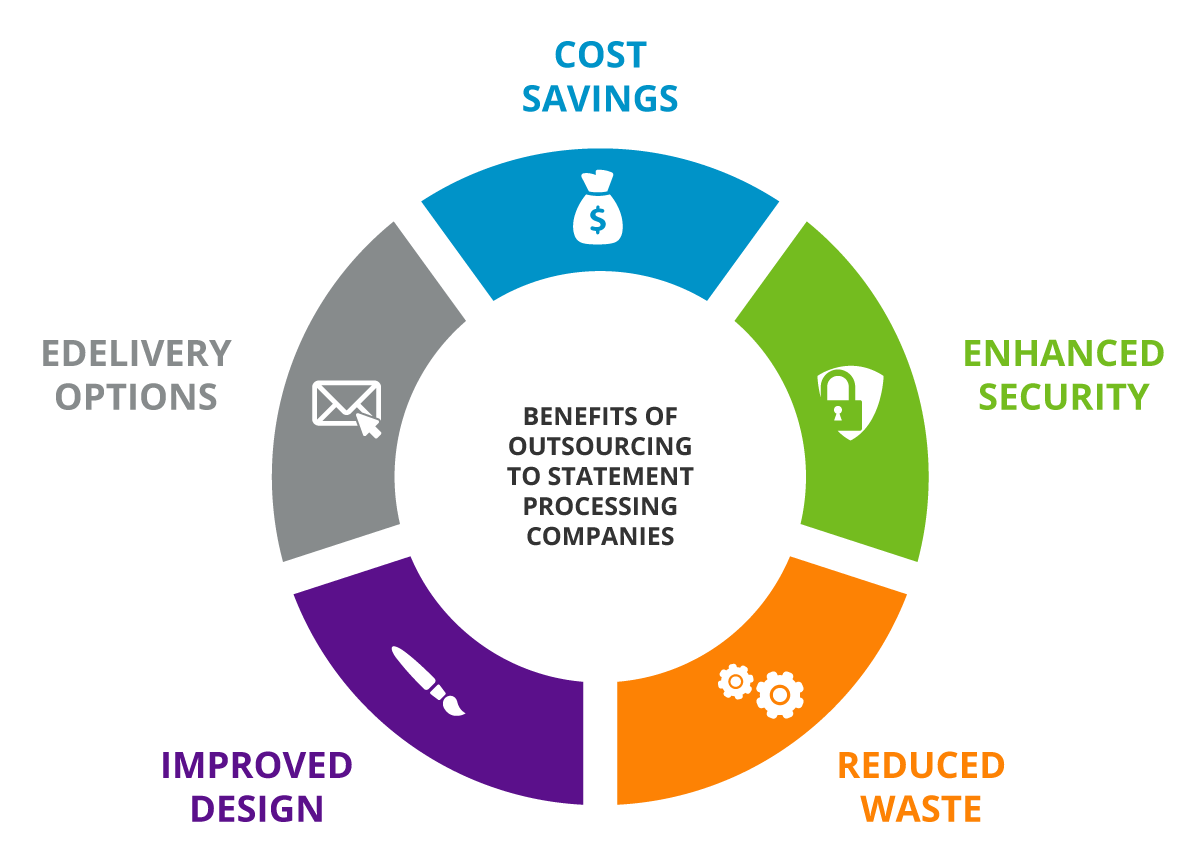

It’s no secret that outsourcing corporate processes can result in significant savings for organizations, both in terms of dollar cost and time. Community banks are one such group that can greatly benefit from outsourcing their printing and mailing processes. By outsourcing their bank statement printing and mailing, community banks can then focus on what they do best—providing an outstanding level of customer service within their local community.

Benefit 1. — Cost Savings

It’s important to note the average bank spends $0.86 for each bank statement they print and mail in-house. To use in an example, this means if a community bank has a base of 100,000 customers, the cost associated with their in-house statement processing services comes to $86,000 a month. In contrast, an outsourcing provider can perform the same printing and mailing services for 30% less, which can result in a significant annual saving of hundreds of thousands of dollars.

Benefit 2. — Enhanced Security

Especially since the advent of COVID-19, data hackers and thieves are focusing their efforts on smaller organizations in the hopes their security measures are less than ideal. In many cases, unfortunately, the criminals are correct. Multiple organizations such as Forbes, report that attacks against smaller businesses have risen significantly since January 2020.

While many smaller community banks were busy trying to establish protocols for how they can serve their customers without compromising their health and safety, they may have taken their focus away from their technology tools and the security risks they can present.

Banks do not need to compromise on the safety and integrity of the vital data they manage when considering outsourcing to statement processing companies. These providers understand the many challenges that smaller organizations face during these exceptional times surrounding data security.

Output Services is SOC 1, 2, and 3 certified. This means all of our communication printing services have been evaluated by an external auditor who deemed that our security systems either meet or exceed worldwide industry security standards.

Benefit 3. — Reduced Waste

Banks know that for their industry, significant waste comes in the forms of returned mail and/or bad customer addresses. The problem associated with this type of print and mail service will exacerbate over time as well. On average, 10% of the population moves every year. Over time, if inaccurate address data is not corrected, a bank’s database will continue to grow. This means in-house staff who don’t necessarily have the proper expertise, must find ways to verify and update old addresses.

Bank statement processing providers use methods such as the ASPS Ancillary Service Endorsements and NCOALink address verification. Both of these processes satisfy the USPS move update requirements for transactional printing services ensuring that address lists for statement printing and mailing services as accurate as possible.

Licensed mailing services such as OSI are granted access to The USPS National Change of Address (NCOA) Move Update system which is updated when an individual notifies the postal service of a move. OSI’s team members are experts in the latest technologies available to automatically update bad addresses with new ones resulting in less mail being lost or returned to the sender.

Benefit 4. — Improved Statement Design

Statement processing companies such as OSI employ talented professionals specifically trained in communicating clear, concise corporate information in a visually appealing manner. They understand that improving a customer’s experience is a top priority for banks. Clutter-free, simple statement designs give recipients the opportunity to read through important information without becoming overwhelmed or confused. Furthermore, billing statements that use personal, easy-to-understand content can help lower financial-related anxiety in consumers.

The use of color and thoughtfully placed text can help highlight important information and improve communications. Branding and transpromotional marketing campaigns can also be incorporated to promote uniformity and increase product awareness.

Statements are a regular form of communication between banks and their account-holders. Outsourcing bank statement printing and mailing services to third-party vendors is not only fiscally responsible, it can help improve customer relations and free up resources as well.

Benefit 5. — eDelivery Options

Ninety-seven percent of millennial respondents from Business Insider’s Intelligence’s Mobile Banking Competitive Edge study stated they regularly use mobile banking applications. With 89 percent of all respondents claiming the same, it is easy to see why banks are investing in new technologies. Setting up intricate mobile banking systems can take time. However, enlisting the help of a third-party vendor such as an output solution provider to help manage and distribute eStatements, gives community banks the benefit of mobile banking without the hefty setup costs.

Summary

If you are a community bank and are looking for a full-service printing and mailing company within the Rocky Mountain and Boulder, Colorado area, Output Services can help. We offer professional bank statement printing services, along with many other automated processes such as compliance letter services, bill printing services, and a wide range of transactional invoicing services as well. Learn more about us or read more of our blog posts.